10.11

2017-01-08

(a)

スポットレート spot rate, s

s = (0.070, 0.073, 0.077, 0.081, 0.084, 0.088)

フォワード・レート forward rate, f

f0,1 = s1 = 0.070

f1,2 = (1+s2)2/(1+s1)1-1 = 1.0732/1.0701-1 = 0.076

f2,3 = (1+s3)3/(1+s2)2-1 = 1.0773/1.0732-1 = 0.085

f3,4 = (1+s4)4/(1+s3)3-1 = 1.0814/1.0773-1 = 0.093

f4,5 = (1+s5)5/(1+s4)4-1 = 1.0845/1.0814-1 = 0.096

f5,6 = (1+s6)6/(1+s5)5-1 = 1.0886/1.0845-1 = 0.108

支払利息のキャッシュフロー cash flow, x 想定元本 A = 1000(unit 1000$)

x1 = A f0,1 = 1000×0.070 = 70 x2 = A f1,2 = 1000×0.076 = 76 x3 = A f2,3 = 1000×0.085 = 85 x4 = A f3,4 = 1000×0.093 = 93 x5 = A f4,5 = 1000×0.096 = 96 x6 = A f5,6 = 1000×0.108 = 108

割引係数 discount factor, d

d1 = 1/(1+s1)1 = 1/1.0701 = 0.935 d2 = 1/(1+s2)2 = 1/1.0732 = 0.869 d3 = 1/(1+s3)3 = 1/1.0773 = 0.800 d4 = 1/(1+s4)4 = 1/1.0814 = 0.732 d5 = 1/(1+s5)5 = 1/1.0845 = 0.668 d6 = 1/(1+s6)6 = 1/1.0886 = 0.603

変動金利の現在価値 present value, PV1

PV1 = x1d1 + x2d2 + x3d3 + x4d4 + x5d5 + x6d6

= 70 × 0.935 + 76 × 0.869 + 85 × 0.800 + 93 × 0.732 + 96 × 0.668 + 108 × 0.603

= 65.5 + 66.0 + 68.0 + 69.0 + 64.1 + 65.1

= 396.7 (1000$)

(b)

固定金利を r と置く。

固定金利のキャッシュフロー cash flow, y

yi = Ar, i=1,2,...,6.

固定金利の割引係数 discount factor, d

di = 1/(1+r)i, i=1,2...,6.

固定金利の現在価値 present value, PV2

PV2 = Σyidi, i=1,2...,6.

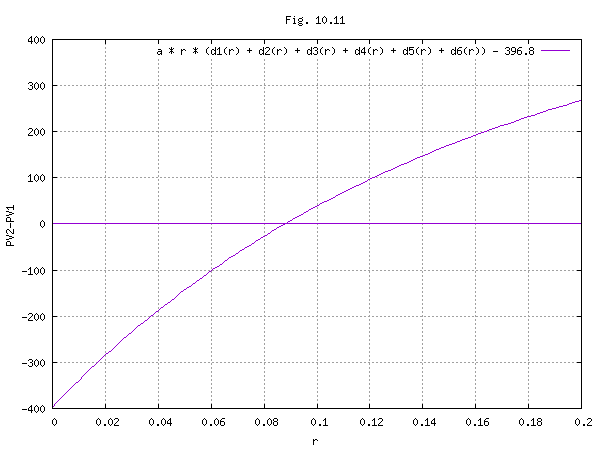

スワップの変動側と固定側の価値が等しい固定側の金利 r は、 次式を満たす。

PV2 - PV1 = 0

すなわち、

1000r[ 1 / (1 + r)1 + 1 / (1 + r)2 + 1 / (1 + r)3 + 1 / (1 + r)4 + 1 / (1 + r)5 + 1 / (1 + r)6 ] - 396.7 = 0 (1)

(1)式を図化すると下図となる。

(1)式をrについて解くと、r = 0.088 である。

図化ファイル

Python

2016-10-23 10.11.py

JavaScript

2024-11-03 10.11.js

Gauche

2024-11-03 10.11.scm

Julia

2024-11-03 10.11.jl

Fortran

2024-11-03 10.11.f90

history

2016-10-22 created.

2016-10-23 typo fixed and python code added.

2017-01-08 typo fixed.

2021-02-19 change XHTML to html5, change shift-jis to utf-8, add viewport.

2024-11-03 add a JavaScript code, a Gauche code, a Julia code and a Fortran code.